Without Prejudice. Preamble: It is vital this information goes far and wide to stop the fear mongering and restore the market to normality and stability!

Without Prejudice. Preamble: It is vital this information goes far and wide to stop the fear mongering and restore the market to normality and stability!

If not, the impact on Spain will have more ramifications than we can yet imagine. This article is not a case of self interest. It is a matter of global concern. About us (new tab)

Reports of 100% Tax on Non-EU residents buying property in Spain are INCORRECT! And they are causing a lot of damage.

Firstly: it is NOT a 100% tax on the property purchase price! Comments

Firstly: it is NOT a 100% tax on the property purchase price! Comments

It is a proposed 100% increase of the RATE of tax levels. A VERY different matter. But even so, there are ways to avoid this double increase IF it happens. Many think that highly unlikely! Summary…

It is NOT for the tax to be calculated at 100% of the full property sales price, as many have incorrectly reported. Reports that have rampantly spread amongst the media (including the BBC, Lord help us!) and web portals, and which are causing considerable disappointment, stress, fear, financial loss and damage to many!

It IS for a doubling of the current tax rate, i.e. from 7% to 14% in Andalucia for example (other provinces vary).

Here is the key point:

Therefore a property being purchased for €200,000 will NOT incur taxes of another €200,000. It would increase from being taxed at €14,000 to €28,000. e.g. €228,000 NOT €400,000! That is a horrific distortion of reality!

Secondly: this may not even happen!

The Spanish Government may well be challenged by the EU who could rule that it is discriminatory. Spain previously implemented a similar discriminatory inheritance tax. This law was challenged in the European courts and was ruled out.

This proposed new law might even be suggested as “racist” because it effectively excludes all English speaking nations and all (other) Spanish speaking South American nations. Also of course China, India, Africa, Russia etc.

(Interestingly, and somewhat of a dichotomy, being overruled by the EU is one of the reasons the UK left it – when a sovereign nation´s lawful decision can be overturned by an external authority. But that is another subject!).

Even if the law is passed, it is likely to take up to a year or longer to come into effect.

Also, it is not clear if it is proposed that the tax increases would be across the whole of Spain or limited to high demand areas such as Madrid, Barcelona and Malaga. There is therefore a long way to go with this and so it should not put off anyone seriously looking to buy a property in Spain.

There are currently a number of tax reductions and incentives in rural areas to encourage property purchases and investment there such as in Galicia and Extremadura. It therefore seems counter-productive to have this tax increase applied in areas where reduced tax regimes are in place.*

Ultimately, if you are planning to buy a property in Spain and have been concerned by the reports of the 100% property tax in Spain, the advice is – “don’t panic!”²

Thirdly: We absolutely agree with Government intentions…

But NOT with the methods. We say more about this further down the page, suggesting alternatives ⇓

What will the European Union eventually decide – are there added complications? Yes.

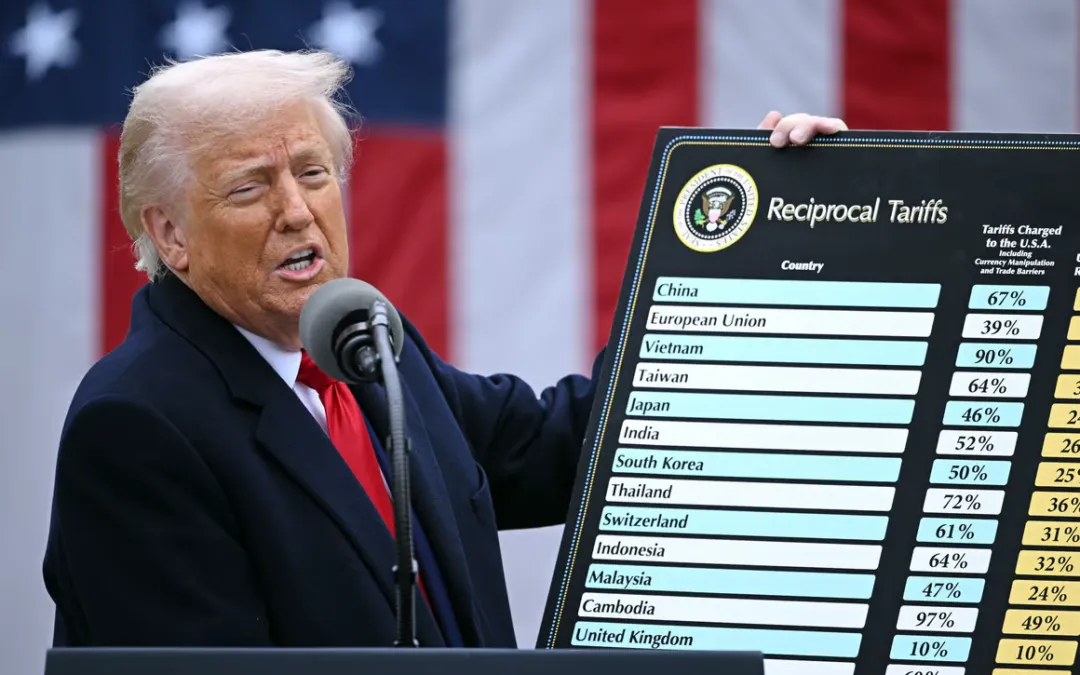

AN ISSUE affecting the EU´s position following US President Donald Trump’s announcement of a 20% trade tax (tariff on all imports to the USA) might influence the EU´s decision.

Note what Trump says the EU charges the USA!!

Concerning the USA tariffs the European Union issued a formal response:

“President Trump’s announcement of universal tariffs, including the EU, is a major blow to the world economy. All businesses – big and small – will suffer from day one. We are clear-eyed about the consequences and prepared to respond. As Europeans, we will always promote and defend our interests and values. We remain engaged towards reducing barriers – not raising them. Moving from confrontation to negotiation. Europe has everything it needs to make it through this storm. We will stand together and stand up for each other. Europe has the largest Single Market in the world – 450 million consumers – that is our safe harbor in tumultuous times. We will stand on the side of those directly impacted: our businesses, our workers, and all Europeans. “Our unity is our strength.”

In any event, and in conclusion: you do NOT have to pay 100% tax on the property price, only the usual 7% in Andalucia, or…

Reduced rates for main residence:

The law establishes a reduced rate of 6% for the acquisition of a principal residence if the value of the property does not exceed 150,000 euros and also for the acquisition of a principal residence by persons under 35 years of age in which the value of the property does not exceed 150,000 euros. In the latter case, the applicable rate is 3.5% in Andalucia.

Reduced rate for real estate professionals:

Similarly, the law determines a reduced rate for real estate professionals. This is a case applicable to professionals who acquire a property to incorporate it into their circulating assets, in which case a reduced rate of 2% is stipulated, on the condition that the property has been transferred within a maximum period of 5 years.

Autonomous community jurisdiction over the ITP in Andalucia:

Competence over the transfer tax is transferred to the autonomous communities, hence the rates we refer to here for the Autonomous Community of Andalusia are not applicable in other regions of Spain, so that the specific case of the place where the property is located will have to be taken into account to determine the rate applicable to each transaction, and the general rate can vary between 6% and 10%.

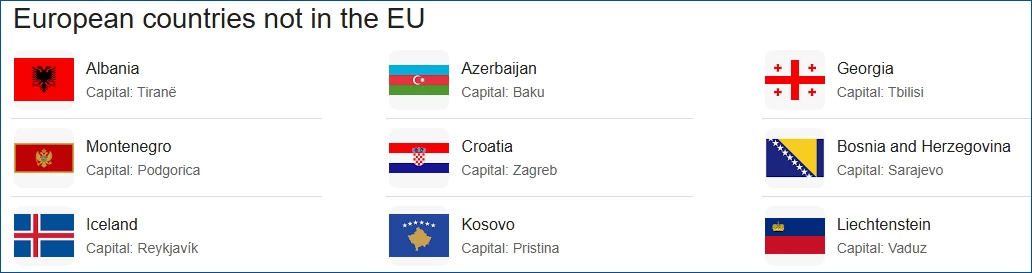

EU member nations are:

Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden.

Plus: Switzerland, Norway, Ukraine & United Kingdom.

Plus: Switzerland, Norway, Ukraine & United Kingdom.

OCCURENCE IF PASSED:

The doubling of the property tax rate could deter foreign investors from considering Spain altogether. This could lead to a significant decline in demand for Spanish real estate, affecting local property markets and related industries such as construction, tourism, and property management. Job losses could be substantial.

We agree to some extent with the sentiment and objectives, but not with the methodology.

We suggest a better alternative to the housing crisis here ⇒

Suggestions for what to discuss with your legal representative:

Consider the Non-Lucrative Visa¹: This automatically entitles you to residency if you do not work. It allows all non-EU citizens to live in Spain if they can support their lifestyle without working. It also allows the applicant’s spouse and children to join them. Also, the holder can travel in the EU’s Schengen area visa-free. In this way you can enjoy tourism throughout most of Europe with restriction.

Consider the Digital Nomad Visa. This is a relatively new resident permit that allows non-EU citizens to live and work remotely from Spain. For example you could be a website designer gaining income from outside of Spain (and inside, although this is sometimes questioned). Spain aims to be one of the leading destinations in attracting entrepreneurs, investors and skilled workers. Although, under the Sanchez proposal this will also be under review. We will update you if you request.

Perhaps establish a Spanish company? It can cost less than €1,000.

If you spend significant time in Spain, it may be worth reviewing your residency status. Establishing a company through a Notary is the best option. Many do, and many Spaniards have all there is assets in a company, not in their private name.

Diversify your investments

If you’re heavily invested in Spanish property, it may be wise to diversify your assets. Consider exploring other markets or investment opportunities to reduce your exposure to potential risks.

FOR BUSINESSES:

1. Choose the Right Business Structure:

It is important to know that choosing the right business structure is critical. For example, if you go with an S corporation or a Limited Liability Company (LLC), you can skip double taxation entirely. These setups let profits flow straight to your personal tax return. So you only have to pay taxes once.

2. Pay Yourself a Reasonable Salary:

By paying yourself a salary, you can reduce the corporate income that is subject to corporate tax. This salary is deductible as a business expense. Thereby lowering the corporation’s taxable income. However, it’s crucial to ensure that the salary is reasonable, aligned with industry standards. Well-documented.

3. Utilize Expense Reimbursements and Fringe Benefits:

As a business owner, you can take advantage of expense reimbursements and certain fringe benefits, which can be considered before-tax expenses for the company. Expenses like travel, meals, and health insurance premiums, if directly tied to business purposes, can be reimbursed without incurring additional personal tax liability.

VAT when buying real estate in Spain:

- The VAT rate of 10% applies to new homes.

- For commercial real estate the high VAT rate of 21% applies.

- For building land, the VAT rate of 21% applies.

- If you buy building land with a construction contract linked to it, the low VAT rate of 10% applies to both.

VAT settlement: In accordance with the Spanish regulations, VAT can be settled or reclaimed, provided that business activities are carried out and the company is registered.

Construction: If you have purchased a property and later have a garage or a swimming pool, the high rate of 21% applies.

Renovation: If you buy a house and carry out renovations where (1) the cost of this amounts to more than 25% of the purchase price and (2) there are actual structure and façade changes, then the house will be equated to new construction and the VAT can will be settled but can be requested returned as an expense.

For importing goods & most services.

From Non-EU nations to Spain: The VAT rate for importing products is 21%, but on certain products a reduced VAT rate of 10% or a reduction of the tax to 4% applies. VAT is calculated on the value of the goods, plus international shipping, insurance costs and import duties.

Within the EU: Spain is party to the European Union’s Common Customs Tariff, therefore preferential rates apply to imports from countries which the EU has signed agreements with. Duties range from 0-17%, with the general tariff averaging 4.2%.

ABOUT CAPITAL GAINS TAX:

Taxes in Spain are split between state, regional and local governments. Each of Spain’s 17 autonomous regions decides its own tax rates and liabilities. This means Spanish tax rates vary across the country.

Under Spanish law, income and capital gains triggered by Spanish real estate properties are taxable in Spain, whether or not they are realized by a Spanish resident or non-resident.

There are no separate taxes for income and capital gains in Spain.

When a non-resident company has a permanent establishment in Spain. Its taxable presence will be determined in accordance with the provisions of corporation tax rules. There are some limitations on the deduction of payments. Such as attributed to the headquarters for fees, interest, commissions, technical assistance services and use or assignment of assets or rights.

Next: Suggested articles…

- Individuals can share commission with us by sending us customers.

- Our proposals for affordable Housing.

- Modern design ideas for Homes in Spain.

- Sell your home anonymously. Anywhere in Spain.

- About us – who we are and what we do.

Our position on this…

Sources:¹Spanish Gov | ²Worldwide Lawyers | |Expatriate Health Care | RSM Global (pdf) | Cunningham & Associates | mael abogados | Easytax Spain.

Disclaimer: This page incorporates content from qualified legal and government sources (see some in the links above). This Government proposal is in process and things may well change. It is essential that you gain legal advice to assess the current situation. We can help you with this.